|

| Alliance Network Footprint |

As a mergers and acquisitions firm, MT Consulting specializes in the sale of privately held healthcare service businesses. Our blog highlights recent industry acquisitions and shares insight for potential sellers.

Friday, April 27, 2018

Alliance Physical Therapy On the Move

Thursday, April 26, 2018

Derm Practice Poised to Go National

Skin & Cancer Associates (SCA), a group dermatology practice, boasts 5 locations throughout Florida. Following a recent partnership with Philadelphia area Susquehanna Private Capital LLC, SCA is now focused on going national.

Skin & Cancer Associates (SCA), a group dermatology practice, boasts 5 locations throughout Florida. Following a recent partnership with Philadelphia area Susquehanna Private Capital LLC, SCA is now focused on going national. The Ft. Lauderdale-based practice management organization with 80 professionals will continue with current leadership, Dr. Reuven Porges, CEO. >>Read more

Wednesday, April 25, 2018

New Jersey Urgent Care Network Adds Location

AtlantiCare Urgent Care, part of Geisinger Health, will add another location to its network with the acquisition of Cape Urgent Care in Cape May, NJ. The acquisition is expected to close June 1. AtlantiCare clinics are located primarily in the central and southern part of the state.

Wednesday, April 18, 2018

Is there a Perfect Time to Sell?

As sell-side business brokers, we're often asked about Timing.

While we could provide a long winded answer, suffice it to say -

There's no perfect time to sell...

There's YOUR time to sell.

That time is when You and the Business are ready.

To that point...

Have you identified life's next step and eagerly await the transition?

Do you have a baseline or current business valuation?

You've heard it repeatedly...Preparation is the cornerstone of a successful sale. Ideally, it starts with a business valuation by a knowledgeable advisor. The assessment offers more than a snapshot of what your business is currently worth. The 360 degree review will likely identify business trends or information gaps as well as pinpoint areas for improvement. Don't overlook or fail to react to these actionable insights. They become the basis for initiatives that over time will increase business value and enhance buyer interest.

Is this the Perfect Time for You to Sell?

Valuations are a core MT Consulting service. Let us assess your business & determine how ready you are. Call us at 610-527-8400.

Monday, March 26, 2018

Action Continues in Derm

2017 was a strong acquisition year for US dermatology firms. It's estimated that the acquisition total was up at least 45% over the previous year. The action continues in 2018... In general, it appears that the larger firms continue to bring smaller practices into their fold. Here's a rundown of some of the first quarter derm acquisitions:

US Dermatology Partners, a portfolio company of ABRY Partners, acquired:

US Dermatology Partners, a portfolio company of ABRY Partners, acquired:

- Practice of Dr. Robert Silverman in Fairfax, VA

- Rabin-Greenberg Dermatology with 3 locations in the Houston area.

- Stillwater Dermatology Clinic's 2 Oklahoma locations

- Metcalf Dermatology with 1 Stillwater, Oklahoma location

Pinnacle Dermatology, supported by Chicago Pacific Founders, acquired:

- Van Dam Dermatology & Laser Center practice location in suburban Chicago

Epiphany Dermatology, based in Austin, acquired:

- Dermatology Associates, Inc. establishing a presence in Missouri

- Frisco Dermatology Laser & Surgery Center located in the Dallas/Ft. Worth metroplex

- Derma Aura Dermatology increasing Affiliated's Phoenix presence to 6 locations

Tuesday, February 06, 2018

Is Disney Leading the Healthcare Bandwagon?

Is Disney the real disruptor?... leading the way in a new approach to controlling healthcare costs. Last week's Amazon, Berkshire Hathaway, JP Morgan Chase healthcare announcement - vague as it was - took a few businesses by surprise, notably healthcare insurers. This week we learn that Disney's plan entails bypassing insurers and contracting directly with Orlando area hospitals for its regional workforce. There's a few players clearly affected... independent physician groups, for one, as well as Disney employees unhappy with a narrowing network of providers. Time will tell if this proves to be the general model that the Big 3 use going forward. >>Read more

Tuesday, January 30, 2018

Warning: Disruption Ahead

News travels fast...so by now, you know that 3 of the top 7 largest U.S. companies are partnering to create another healthcare company presumably to drive down costs for their respective 950,000 employees. There's NO question that when Amazon, Berkshire Hathaway and JP Morgan Chase speak... the stock market listens. Although it was a vague announcement - not the actual plan - the potential disruption was significant enough to rock the stock market Tuesday morning, especially healthcare insurers. Stay Tuned... >>Read more.

Wednesday, January 10, 2018

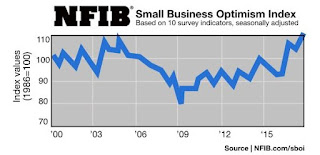

Small Biz Optimism off the Chart!

The National Federation of Independent Businesses (NFIB) released its latest findings regarding optimism among small business owners and 2017 was a record setting year!

The National Federation of Independent Businesses (NFIB) released its latest findings regarding optimism among small business owners and 2017 was a record setting year! In fact, small-business confidence was the highest in the history of the NFIB survey -drawn from the organization's membership. Prior to last year, the previous record was set in 2004. Driving 2017 optimism was the expectation of better economic policies from Washington according to NFIB research. >>Read more

Thursday, January 04, 2018

It's a New Year for CTC...

Congratulations & Cheers... to MT Consulting client, Suzan Syron, on the recent sale of her company to Theraplay. As owner of the multi-site The Children's Therapy Center, Sue has been providing exceptional pediatric therapy services to northern Virginia children for over 35 years. Lisa Mackell, Theraplay's founder, is excited to continue Sue's high level of care as Theraplay expands into Virginia. >>Read more

Congratulations & Cheers... to MT Consulting client, Suzan Syron, on the recent sale of her company to Theraplay. As owner of the multi-site The Children's Therapy Center, Sue has been providing exceptional pediatric therapy services to northern Virginia children for over 35 years. Lisa Mackell, Theraplay's founder, is excited to continue Sue's high level of care as Theraplay expands into Virginia. >>Read more We wish Sue, the CTC and Theraplay staffs continued success in 2018!

Wednesday, December 06, 2017

Optum's Reach Increases

Optum, a division of UnitedHealthcare, is set to expand its patient care options across the U.S. with the recently announced agreement to acquire DaVita Medical Group. Optum's medical care delivery system currently includes a network of surgical centers, urgent care centers and a HouseCall program. DaVita Medical Group will add 300 medical clinics and 6 surgical centers concentrated in Florida, California, Colorado, Washington, Nevada and New Mexico to the system.

Optum, a division of UnitedHealthcare, is set to expand its patient care options across the U.S. with the recently announced agreement to acquire DaVita Medical Group. Optum's medical care delivery system currently includes a network of surgical centers, urgent care centers and a HouseCall program. DaVita Medical Group will add 300 medical clinics and 6 surgical centers concentrated in Florida, California, Colorado, Washington, Nevada and New Mexico to the system.DaVita is best-known for its nationwide network of 2,470 outpatient dialysis centers. This unit is not part of the UnitedHealth/Optum $4.9 billion deal which is subject to regulatory approvals. >>Read more

Related:

UnitedHealth Increases Footprint

Wednesday, November 22, 2017

Pays to Think Like a Buyer

|

Did you know... MT Consulting was founded as a Buy-side broker? Our first few years were focused on identifying and buying businesses for our clients.

Now, as a Sell-side broker, we leverage that buyer mind-set and insight when guiding business owners through the sales process.

Truth is - not all businesses that go to market actually sell. And, that's a sobering thought to current or soon-to-be Sellers banking on sale proceeds to fund a sizable portion of their retirement.

How can Sellers ensure a Payday?

Think like a Buyer!

Understand buyer needs, priorities, "deal killer" issues and prepare the business for a sale accordingly.

Start Here...

>> Know the value of your business.

Call an expert to perform a current valuation.

>> Address internal issues ASAP (especially those impacting

profit or revenue); demonstrate business' money making ability.

>> Engage advisors to effectively package & position the business.

>> Build trust.

Project realistically.

Be forthcoming & honest to buyer info requests.

Disclose weaknesses upfront.

>> Be prepared.

Organize key business reports in advance to facilitate quick responses to buyer inquiries.

Identify growth ideas or plans.

>> Overcome "deal killers" with creativity.

Collaborate with advisors to identify work-arounds or compromises to keep your deal moving forward.

With an estimated 4.5 million* firms up for sale within the next 10 years, competition will be intense. Greater awareness of a buyer's approach today or tomorrow, will reward Seller's with an edge in attracting prospective buyers and negotiating a more lucrative, less time consuming deal.

* The Exit Planning Institute

|

66% of American businesses are owned by Baby Boomers...

who are set to transition their business in the next 5-10 years.*

|

Is it Time for an updated business valuation?

Or, is it Time to sell? We can help! Call us at 610-527-8400.

|

Tuesday, November 21, 2017

U.S. Dermatology Partners Speeding Along...

U.S. Dermatology Partners (USDP), backed by private equity firm ABRY Partners, actively expanded its geography throughout 2017. Add-ons in 2017 have included partners in Colorado, Texas, Arizona:

U.S. Dermatology Partners (USDP), backed by private equity firm ABRY Partners, actively expanded its geography throughout 2017. Add-ons in 2017 have included partners in Colorado, Texas, Arizona:- Medical Dermatology Specialists

- Medical Center Dermatology

- Lakeway Dermatology

- North Texas Dermatology

- Southwest Skin Specialists

- Skin Spectrum

The Dallas-based firm is one of the largest physician-owned practices in the U.S. Formerly known as Dermatology Associates, U.S. Dermatology Partners currently boasts 70 locations across 7 states (Texas, Kansas, Missouri, Arizona, Colorado, Louisiana and Maryland).

Friday, November 10, 2017

Congratulations to MT Clients!

Several MT Consulting clients have recently joined the growing Ivy Rehab Network that now boasts 95 locations in the Mid-Atlantic, Midwest and Southeast.

We wish you all continued success!

Congrats...

Rich & Lori - Focus Physical Therapy + Fitness

Gina & Janis - Northern Physical Therapy

Mike & Barb - Fenton Physical Therapy

We wish you all continued success!

Tuesday, October 31, 2017

UC Giants Merge

Two large healthcare organizations announced the proposed merger of their respective urgent care operations. Select Medical's Concentra and Dignity Health's U.S. Healthworks will come together to "strengthen the delivery of clinical care, standardize best practices and improve service for employers and employees." according to Dignity Chief Financial Officer Daniel Morissette.

Dignity's subsidiary, U.S. HealthWorks, operates 250 occupational healthcare centers in 21 states whereas Concentra has 315 occupational health centers in 38 states.

This transaction will build upon an early 2017 joint venture between Select Medical and Dignity. The two giants will build and manage a Las Vegas area acute inpatient rehabilitation hospital due to open in 2019. The joint operation also is expected to include 12 jointly run outpatient rehabilitation clinics. >>Read more

Dignity's subsidiary, U.S. HealthWorks, operates 250 occupational healthcare centers in 21 states whereas Concentra has 315 occupational health centers in 38 states.

This transaction will build upon an early 2017 joint venture between Select Medical and Dignity. The two giants will build and manage a Las Vegas area acute inpatient rehabilitation hospital due to open in 2019. The joint operation also is expected to include 12 jointly run outpatient rehabilitation clinics. >>Read more

Tuesday, October 10, 2017

Healthy M&A projected for Behavioral Health Sector

Market fragmentation continues in the behavioral health sector and so does its appeal among private equity firms. In a report by Stout, an advisory firm, interest in the sector has bounced back in 2017 after a lull in 2016. In a recent transaction, The Halifax Group announced recapitalization of Florida-headquartered Delphi Behavioral Health Group LLC, a leading substance abuse treatment provider. Delphi led by CEO Dominic Sirianni and his management team will maintain an ownership position along with The Halifax Group. >>Read more

Wednesday, September 13, 2017

Who's In...Who's Out?

It's September...the home stretch for baseball's 2017 regular season. We'll soon know who's going into post-season play and who's out.

Regardless

of whether a team exits the race early or advances to the World Series,

all MLB GMs are tasked with addressing team needs to bolster playoff

hopes or prep for the next season. Their needs are generally unique.

Take the Phillies, for example. This season they needed pitchers while

the Mets needed players that stayed healthy. And so it goes for all 32

teams...

The

scenario reminds me of healthcare service platform companies. Whether

backed by private equity or publicly-owned, their management is

generally focused on growing or gaining market share. Take physical

therapy - a sector we know well. There are more than 20 PT platforms in

the US, each with a unique seller profile, target geo or specialty and

of course, budget.

For

practice owners contemplating a sale, evaluating which platforms to

approach can be overwhelming - and that's only a small part of the sales

process. As business brokers, our team touches all bases: scouts the

prospective buyers, manages due diligence, negotiates the contract and

delivers the best deal for your business.

So, if you're interested in Selling...Call us (610-527-8400). Let's hit one outta the ballpark together.

Wednesday, August 16, 2017

Surgery Partners Closes In on Acquisition

Nashville-based Surgery Partners cleared various regulatory hurdles to close in on the acquisition of National Surgical Healthcare by month end. The acquisition yields a diversified inpatient and outpatient surgical provider with 125 surgical facilities, 58 physician practice locations operating in 32 states. >>Read more Funding for the acquisition will be provided in part by Bain Capital Private Equity.

When announcing the proposed acquisition earlier this year, Mike Doyle, Surgery Partners CEO expressed the following:

When announcing the proposed acquisition earlier this year, Mike Doyle, Surgery Partners CEO expressed the following:

“We are very excited about the acquisition of National Surgical Healthcare and welcome our new partnership with Bain Capital Private Equity. I would like to welcome the NSH team and physicians. This transaction strengthens our market position and will provide new opportunities to introduce ancillary services to our expanded network of surgical facilities..."

Tuesday, August 08, 2017

KKR Healthcare Portfolio Increases

Buyout firm, Kohlberg Kravis Roberts & Co. (KKR), is adding life to its healthcare portfolio with planned acquisitions of Covenant Surgical Partners and American Medical Response (AMR).

Nashville, TN-based Covenant Surgical Partners is a leading operator of ambulatory surgery centers with 37 locations. >>Read more Sellers include DFW Capital Partners, Iroquois Capital Group and PineBridge Investments.

In a deal valued at $2.4 Billion, Envision Healthcare Corp. is selling American Medical Response (AMR) to KKR. AMR is the nation's largest provider of ambulance services. The proposed acquisition offers synergy with an KKR's existing portfolio company. KKR's Air Medical Group Holdings is a leading provider of emergency air medical transportation services to individuals with critical health issues or injuries. >>Read more

Nashville, TN-based Covenant Surgical Partners is a leading operator of ambulatory surgery centers with 37 locations. >>Read more Sellers include DFW Capital Partners, Iroquois Capital Group and PineBridge Investments.

In a deal valued at $2.4 Billion, Envision Healthcare Corp. is selling American Medical Response (AMR) to KKR. AMR is the nation's largest provider of ambulance services. The proposed acquisition offers synergy with an KKR's existing portfolio company. KKR's Air Medical Group Holdings is a leading provider of emergency air medical transportation services to individuals with critical health issues or injuries. >>Read more

Friday, June 09, 2017

It's All About the Metrics

"Without data, you are just another person with an opinion. "

~ W. Edwards Deming

While it's fine to have an opinion & keen insight.…owners are expected to share more when their business is For Sale. After all, it’s the numbers that tell the story that prospective buyers want to hear.

Thanks to technology, there are numerous tools to measure metrics and neatly populate data into worksheets, scorecards or dashboards. While the data may visually look good, is it helping you run a business that will impress buyers down the road?

Not all metrics are created equal; Nor does one-size-fit all...

Whether you're preparing for a sale or not - Focus on business goals that are critical or need improvement. Measure only what's important relative to your goals. Avoid the trap of too much data and "Analysis Paralysis".

Relevant but Not Easy

Consider a common example of a metric...BMI. The index devised by a European in the 1830's is familiar to many but seldom computed without a calculator or Fitbit. The required conversion of weight (pounds to kilograms) and height (inches to meters) is just too cumbersome for most of us on this side of the Atlantic.

Relevant, Easy, Actionable

We work with many healthcare industry clients and have found a few specific metrics helpful in assessing ongoing performance. If your business is healthcare-related, have you considered adding the following to your analysis...

- Revenue* per FTE: This is a quick way to assess how much money your business generates per full-time employee. Track it monthly and yearly - it's easy to do and will alert you to both good and bad trends.

- Revenue* per revenue-generating employee: Most businesses have 2 types of employees - those providing billable services & those providing business support. It's an easy to track metric that can signal the need to ramp up employee productivity.

- Payroll hours/visit: Another productivity metric which involves hours of payroll paid in a pay period divided by total patients seen (same pay period). In a practice not doing complex procedures, the result should range between 1.5 - 2 hours per visit. (Include salaried and hourly staff in computation.)

*Cash collected

Have a question about the right metrics for your business? Don't hesitate to call us, we can help...610-527-8400.

Subscribe to:

Posts (Atom)